Exness Forex Trading in the Philippines

Home » Exness Forex Trading

Understanding Forex Trading at Exness

Forex trading involves the simultaneous buying and selling of currency pairs in the foreign exchange market. Exness provides access to over 100 currency pairs through MetaTrader 4 and MetaTrader 5 platforms, enabling traders in the Philippines to participate in the global currency market.

The forex market operates 24 hours a day, five days a week, with trading sessions spanning different time zones. Currency prices fluctuate based on economic factors, political events, and market sentiment, creating opportunities for profit through price movements.

Available Currency Pairs

Major Currency Pairs

Major pairs represent the most liquid currency combinations, featuring the US Dollar paired with other major economies:

Currency Pair | Description | Typical Spread |

EUR/USD | Euro vs US Dollar | From 0.0 pips |

GBP/USD | British Pound vs US Dollar | From 0.1 pips |

USD/JPY | US Dollar vs Japanese Yen | From 0.1 pips |

USD/CHF | US Dollar vs Swiss Franc | From 0.2 pips |

AUD/USD | Australian Dollar vs US Dollar | From 0.3 pips |

USD/CAD | US Dollar vs Canadian Dollar | From 0.3 pips |

NZD/USD | New Zealand Dollar vs US Dollar | From 0.4 pips |

Minor Currency Pairs

Minor pairs exclude the US Dollar but include other major currencies:

- EUR/GBP (Euro vs British Pound)

- EUR/JPY (Euro vs Japanese Yen)

- GBP/JPY (British Pound vs Japanese Yen)

- AUD/JPY (Australian Dollar vs Japanese Yen)

- CHF/JPY (Swiss Franc vs Japanese Yen)

- CAD/JPY (Canadian Dollar vs Japanese Yen)

Exotic Currency Pairs

Exotic pairs combine major currencies with emerging market currencies:

- USD/TRY (US Dollar vs Turkish Lira)

- EUR/TRY (Euro vs Turkish Lira)

- USD/ZAR (US Dollar vs South African Rand)

- USD/MXN (US Dollar vs Mexican Peso)

Trading Platforms for Forex

MetaTrader 4 Features

MetaTrader 4 provides comprehensive forex trading capabilities:

Technical Analysis Tools

- 30 built-in technical indicators

- 24 analytical objects

- 9 timeframes for chart analysis

- Custom indicator support

- Expert Advisor compatibility

Order Types

- Market orders for immediate execution

- Pending orders (Buy Limit, Sell Limit, Buy Stop, Sell Stop)

- Stop Loss and Take Profit levels

- Trailing stops for dynamic risk management

Platform Specifications

- One-click trading functionality

- Real-time price quotes

- Economic calendar integration

- News feed access

- Mobile trading support

MetaTrader 5 Capabilities

MetaTrader 5 offers enhanced features for forex trading:

Advanced Charting

- 21 timeframes for detailed analysis

- 38 technical indicators

- 44 analytical objects

- Volume analysis tools

- Market depth information

Order Management

- 6 pending order types

- Partial position closing

- Position netting and hedging

- Advanced stop orders

- Market execution mode

Additional Features

- Economic calendar with impact levels

- Market sentiment indicators

- Copy trading functionality

- Algorithmic trading support

- Multi-asset trading capability

Web Terminal Access

The Exness Web Terminal enables forex trading directly through web browsers:

- No software installation required

- Cross-platform compatibility

- Real-time market data

- Complete order management

- Technical analysis tools

- Account management functions

Account Types for Forex Trading

Standard Account Specifications

Standard accounts provide basic forex trading conditions:

- Minimum deposit: $1

- Maximum leverage: 1:2000

- Spread type: Variable

- Starting spreads: From 0.3 pips

- Commission structure: None

- Execution type: Market execution

- Minimum trade size: 0.01 lots

Standard Cent Account Details

Cent accounts allow smaller position sizes for risk management:

- Minimum deposit: $1

- Maximum leverage: 1:2000

- Spread type: Variable

- Starting spreads: From 0.3 pips

- Commission structure: None

- Trade size: Measured in cents

- Position sizing: 0.01 cent lots minimum

Pro Account Conditions

Pro accounts offer enhanced trading conditions:

- Minimum deposit: $200

- Maximum leverage: 1:2000

- Spread type: Variable

- Starting spreads: From 0.1 pips

- Commission structure: None

- Execution type: Instant execution

- Stop out level: 0%

Raw Spread Account Terms

Raw Spread accounts provide direct market pricing:

- Minimum deposit: $200

- Maximum leverage: 1:2000

- Spread type: Variable from market

- Starting spreads: From 0.0 pips

- Commission: Up to $3.5 per lot per side

- Execution type: Market execution

- ECN-style pricing model

Zero Account Features

Zero accounts offer minimal spreads on major pairs:

- Minimum deposit: $500

- Maximum leverage: 1:2000

- Spread type: Variable

- Starting spreads: From 0.0 pips on 30 instruments

- Commission structure: None on zero spread instruments

- Execution type: Market execution

- Premium pricing model

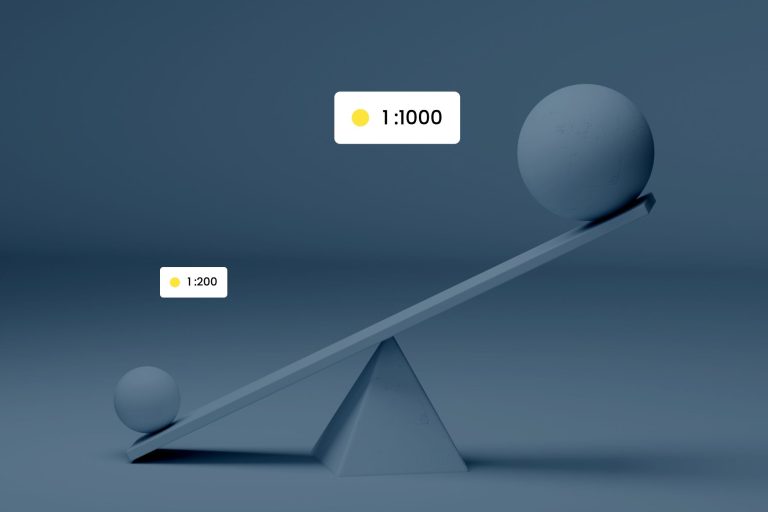

Leverage and Margin Requirements

Leverage Options

Exness provides flexible leverage settings for forex trading:

Account Balance | Maximum Leverage | Margin Requirement |

0−0 – 0−999 | 1:Unlimited | Dynamic calculation |

1,000−1,000 – 1,000−4,999 | 1:2000 | 0.05% |

5,000−5,000 – 5,000−29,999 | 1:1000 | 0.1% |

$30,000+ | 1:500 | 0.2% |

Margin Calculation Methods

Standard Lot Calculation

For major currency pairs, one standard lot equals 100,000 units of the base currency. Margin requirements vary based on leverage settings and account balance.

Margin Call Levels

- Margin call: 60% of equity

- Stop out level: 0% for Pro accounts, 20% for Standard accounts

- Free margin monitoring for position management

Dynamic Leverage System

Exness implements dynamic leverage based on:

- Total account equity

- Open position exposure

- Market volatility conditions

- Currency pair specifications

- Trading session timing

Trading Sessions and Market Hours

Asian Trading Session

The Asian session operates during Philippine business hours:

- Session times: 23:00 – 08:00 GMT

- Active currency pairs: USD/JPY, AUD/USD, NZD/USD

- Market characteristics: Lower volatility, range-bound movements

- Economic releases: Japanese and Australian data

European Trading Session

The European session provides increased volatility:

- Session times: 07:00 – 16:00 GMT

- Active currency pairs: EUR/USD, GBP/USD, USD/CHF

- Market characteristics: High liquidity, trend developments

- Economic releases: European Central Bank announcements

American Trading Session

The American session overlaps with European hours:

- Session times: 12:00 – 21:00 GMT

- Active currency pairs: USD-based majors

- Market characteristics: High volatility, news-driven movements

- Economic releases: Federal Reserve communications

Order Execution and Spreads

Execution Models

Market Execution

Orders execute at current market prices with potential slippage during high volatility periods. This model provides:

- Fast order processing

- No requotes

- Partial fills possible

- Price improvement opportunities

Instant Execution

Orders execute at requested prices or reject if prices move beyond tolerance levels. Features include:

- Fixed spread environments

- Requote mechanisms

- Price confirmation requirements

- Slippage control options

Spread Structures

Variable Spreads

Spreads fluctuate based on market conditions:

- Tighter during high liquidity periods

- Wider during low liquidity or high volatility

- Market-driven pricing

- No artificial spread widening

Commission-Based Pricing

Raw Spread and Zero accounts use commission structures:

- Direct market spreads

- Transparent commission charges

- ECN-style pricing model

- Institutional-level access

Risk Management Tools

Stop Loss Orders

Stop loss orders limit potential losses by closing positions at predetermined levels:

- Automatic execution when price reaches stop level

- Configurable during order placement

- Modifiable for open positions

- Guaranteed execution on major pairs

Take Profit Orders

Take profit orders secure profits by closing positions at target levels:

- Automatic profit realization

- Multiple take profit levels possible

- Partial closing capabilities

- Risk-reward ratio optimization

Position Sizing Strategies

Fixed Fractional Method

Calculate position size based on account percentage risk:

- Determine acceptable loss percentage

- Calculate stop loss distance in pips

- Apply position sizing formula

- Adjust for currency pair pip values

Volatility-Based Sizing

Adjust position size according to market volatility:

- Use Average True Range (ATR) indicators

- Scale positions inversely to volatility

- Maintain consistent risk exposure

- Adapt to changing market conditions

Economic Calendar and Fundamental Analysis

High-Impact Events

Monitor these events for forex trading opportunities:

Central Bank Decisions

- Federal Reserve interest rate decisions

- European Central Bank policy meetings

- Bank of Japan monetary policy statements

- Bank of England rate announcements

Economic Indicators

- Non-Farm Payrolls (United States)

- Consumer Price Index data

- Gross Domestic Product releases

- Employment statistics

Political Events

- Election outcomes

- Trade negotiations

- Geopolitical developments

- Policy announcements

News Trading Strategies

Breakout Trading

Position for price breakouts following news releases:

- Identify consolidation patterns before news

- Place pending orders above and below current range

- Implement tight stop losses

- Target extended price movements

Fade Trading

Trade against initial news reactions:

- Wait for immediate price spike

- Assess reaction sustainability

- Enter counter-trend positions

- Use technical levels for targets

Mobile Trading Applications

Exness Trader App Features

The Exness Trader mobile application provides:

- Real-time price quotes

- One-tap trading functionality

- Technical analysis tools

- Account management capabilities

- Push notification alerts

- Biometric security options

MetaTrader Mobile Platforms

MetaTrader mobile applications offer:

MetaTrader 4 Mobile

- Complete trading functionality

- Technical indicator library

- Expert Advisor support

- Price alert systems

- Chat community features

MetaTrader 5 Mobile

- Advanced charting tools

- Economic calendar integration

- Market depth information

- Copy trading access

- Multi-asset trading support

Frequently Asked Questions

What are the minimum and maximum trade sizes for forex trading at Exness?

Minimum trade size is 0.01 lots for most currency pairs, while maximum trade size varies by account type and currency pair. Standard accounts support up to 200 lots per order, while professional accounts may have higher limits.

How does Exness calculate swap rates for overnight forex positions?

Swap rates are calculated based on the interest rate differential between the two currencies in a pair, plus or minus Exness’s markup. Rates are applied at 00:00 server time and tripled on Wednesdays to account for weekend rollover.

Can I hedge forex positions on the same currency pair with Exness?

Yes, Exness supports hedging on MetaTrader platforms, allowing you to hold both long and short positions on the same currency pair simultaneously. This feature is available on all account types.

What happens to my forex trades during market gaps or low liquidity periods?

During market gaps, orders may experience slippage, executing at the first available price. Exness implements negative balance protection to prevent account balances from going below zero due to gap-related losses.

Are there any restrictions on forex trading strategies or scalping at Exness?

Exness permits all trading strategies, including scalping, hedging, and automated trading. There are no restrictions on holding periods, trade frequency, or profit targets for forex positions.