Calculator Exness Philippines Trading Position Size Tool

Home » Trading Calculator

Trading Calculator Tools for Exness Philippines Users

Exness provides multiple calculator tools for traders in Philippines to calculate position sizes, margins, and potential profits. These tools help traders make informed decisions before opening positions. Accurate calculations reduce risk and improve trading outcomes.

The platform offers calculators for different trading scenarios. Each tool serves specific purposes in trade planning. Traders can access these calculators without logging into their accounts.

Position Size Calculator

How Position Sizing Works

Position size determines the number of lots to trade based on account balance and risk tolerance. The calculator considers account currency, risk percentage, and stop loss distance. Proper position sizing prevents excessive losses on single trades.

The formula includes:

- Account balance in base currency

- Risk percentage per trade

- Stop loss distance in pips

- Currency pair pip value

Calculator Input Parameters

Parameter | Description | Example |

Account Balance | Total trading capital | $10,000 |

Risk Percentage | Maximum loss per trade | 2% |

Stop Loss | Distance in pips | 50 pips |

Currency Pair | Trading instrument | EUR/USD |

Account Currency | Base account currency | USD |

Position Size Formula

The calculator uses this calculation:

Position Size = (Account Balance × Risk %) ÷ (Stop Loss in Pips × Pip Value)

For EUR/USD with 10,000account,2PositionSize=(10,000 account, 2% risk, 50 pip stop loss:

Position Size = (10,000account,2PositionSize=(10,000 × 0.02) ÷ (50 × $10) = 0.4 lots

Margin Calculator

Margin Requirements by Instrument

Different instruments require varying margin amounts based on leverage settings:

Instrument Type | Leverage | Margin Required |

Major Forex Pairs | 1:2000 | 0.05% |

Minor Forex Pairs | 1:1000 | 0.1% |

Exotic Pairs | 1:500 | 0.2% |

Gold/Silver | 1:400 | 0.25% |

Oil Products | 1:200 | 0.5% |

Stock Indices | 1:400 | 0.25% |

Individual Stocks | 1:20 | 5% |

Cryptocurrencies | 1:400 | 0.25% |

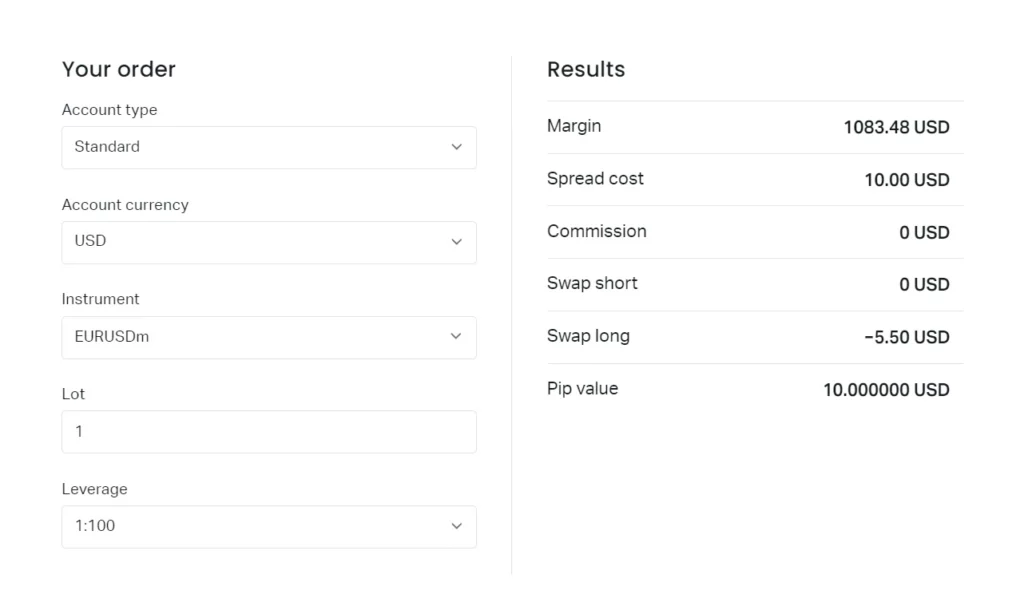

Margin Calculation Process

The margin calculator determines required capital for position opening:

- Select trading instrument

- Enter position size in lots

- Choose account leverage

- Input current market price

- View required margin amount

Margin = (Position Size × Contract Size × Market Price) ÷ Leverage

Profit and Loss Calculator

P&L Calculation Methods

The profit/loss calculator shows potential outcomes before trade execution:

Long Position Calculation:

Profit = (Closing Price – Opening Price) × Position Size × Contract Size

Short Position Calculation:

Profit = (Opening Price – Closing Price) × Position Size × Contract Size

Calculator Features

Feature | Function |

Real-time Prices | Uses current market rates |

Multiple Currencies | Converts to account currency |

Pip Value Display | Shows pip worth in base currency |

Percentage Returns | Calculates ROI on margin |

Break-even Points | Determines zero-profit levels |

Practical Example

EUR/USD trade scenario:

- Position: Buy 1 lot (100,000 units)

- Entry price: 1.0850

- Exit price: 1.0900

- Profit: (1.0900 – 1.0850) × 100,000 = $500

Pip Value Calculator

Understanding Pip Values

Pip values vary depending on currency pairs and position sizes. The calculator determines monetary value of each pip movement. This information helps traders set appropriate stop losses and take profits.

Pip Value Calculation

Currency Pair Type | Pip Position | Calculation Method |

Direct Quotes | 4th decimal place | 0.0001 |

Indirect Quotes | 4th decimal place | 0.0001 |

JPY Pairs | 2nd decimal place | 0.01 |

Crypto Pairs | Varies by instrument | Variable |

For standard lot (100,000 units):

- EUR/USD: 1 pip = $10

- GBP/JPY: 1 pip = ¥1,000

- USD/CHF: 1 pip = CHF 10

Position Size Impact on Pip Value

Position Size | EUR/USD Pip Value |

0.01 lots (micro) | $0.10 |

0.1 lots (mini) | $1.00 |

1 lot (standard) | $10.00 |

10 lots | $100.00 |

Swap Calculator

Overnight Interest Calculations

Swap rates apply to positions held overnight. The calculator shows daily interest charges or credits. Rates depend on interest rate differentials between currencies.

Swap Rate Factors

Swap calculations consider:

- Central bank interest rates

- Broker markup

- Position direction (buy/sell)

- Position size

- Number of days held

Swap Calculation Formula

Daily Swap = (Position Size × Contract Size × Swap Rate) ÷ 365

For 1 lot EUR/USD with -2.5 swap rate:

Daily Swap = (1 × 100,000 × -2.5) ÷ 365 = -$0.68

Fibonacci Calculator

Retracement Level Calculations

The Fibonacci calculator identifies potential support and resistance levels. Traders input high and low prices to generate retracement levels. These levels help determine entry and exit points.

Standard Fibonacci Levels

Level | Percentage | Common Use |

0.0% | 100% retracement | Trend start |

23.6% | 76.4% retracement | Minor pullback |

38.2% | 61.8% retracement | Moderate pullback |

50.0% | 50% retracement | Halfway point |

61.8% | 38.2% retracement | Deep pullback |

78.6% | 21.4% retracement | Very deep pullback |

100% | 0% retracement | Trend end |

Currency Converter

Real-time Exchange Rates

The currency converter uses live market rates for accurate conversions. Traders can convert between any supported currencies. This tool helps calculate cross-currency exposure and profit conversions.

Supported Currencies

Major currencies available:

- USD, EUR, GBP, JPY, CHF

- AUD, CAD, NZD, SGD

- NOK, SEK, DKK, PLN

- PHP, THB, MYR, IDR

Conversion Features

Feature | Description |

Live Rates | Real-time market pricing |

Historical Data | Past exchange rates |

Rate Alerts | Price movement notifications |

Chart Integration | Visual rate trends |

Economic Calendar Integration

Calculator Enhancement with News Events

Economic events impact trading calculations. The platform integrates news calendar data with calculator tools. Traders can adjust calculations based on upcoming announcements.

Event Impact Levels

Impact Level | Description | Calculator Adjustment |

High | Major economic releases | Increase margin requirements |

Medium | Moderate market movers | Standard calculations |

Low | Minor announcements | No adjustment needed |

Mobile Calculator Access

Mobile Application Features

Exness mobile apps include calculator functionality:

- Position size calculations

- Margin requirement checks

- Real-time pip values

- P&L projections

Calculator Synchronization

Calculator settings sync across platforms:

- Desktop web browser

- Mobile applications

- Trading platforms

- Personal area

Calculator Accuracy and Updates

Data Source Reliability

Calculators use institutional-grade price feeds. Data updates occur in real-time during market hours. Accuracy levels match trading platform pricing.

Calculation Verification

Users can verify calculator results against:

- Trading platform displays

- Third-party financial websites

- Manual calculations

- Historical trade data

Advanced Calculator Features

Multi-Position Calculations

Advanced tools calculate portfolio-level metrics:

- Total margin requirements

- Combined position exposure

- Portfolio risk assessment

- Correlation analysis

Custom Parameter Settings

Setting | Options | Default |

Base Currency | Multiple currencies | USD |

Risk Level | 1-10% | 2% |

Calculation Method | Standard/Custom | Standard |

Time Zone | Global zones | Server time |

Calculator API Integration

Third-party Platform Support

Calculators integrate with external platforms:

- TradingView indicators

- Excel spreadsheets

- Custom trading software

- Portfolio management tools

API Specifications

Available data endpoints:

- Real-time pricing

- Historical rates

- Calculation results

- Market parameters

Frequently Asked Questions

Are calculator results guaranteed accurate?

Calculator results reflect real-time market conditions but actual trading may vary due to spreads and slippage.

Can I save calculator settings?

Yes, registered users can save preferred calculator parameters in their personal area.

Do calculators work for all account types?

Calculators support all Exness account types with appropriate margin and leverage settings.

Are mobile calculator features identical to desktop?

Mobile calculators provide core functionality with simplified interfaces optimized for smaller screens.

How often do calculator rates update?

Rates update in real-time during market hours, typically every few seconds.

Can I use calculators without an Exness account?

Basic calculator functions are available without registration, but saved settings require an account.

Do calculators include trading costs?

Calculators show gross calculations; actual trading costs depend on spreads and commissions.

Are calculator results binding for trades?

Calculator results are estimates; actual trade execution may differ based on market conditions.

Can I calculate exotic currency pairs?

Yes, calculators support all tradeable currency pairs available on the platform.

Do calculators account for weekend gaps?

Calculators use current market prices and do not predict weekend gap scenarios.